Getting Started on Your Home Purchase

Buying a home can be a complex process, but it doesn’t have to be hard. With a little preparation up front, you can save a lot of time and hassle.

Be Prepared

In order to consider a loan application, all lenders need personal information to verify employment for you and your co-borrower (if there is one). Information regarding debts and assets also is required.

To expedite the paperwork process, gather the following items:

-

-

- Most recent paystubs for one month

- W2s from the last two years

- Signed copies of your last two years’ Federal tax returns, including all schedules

- Homeowners insurance company name and number

- Most recent asset statements for two months (checking, savings, investment, retirement)

-

First Time Buyer

Finding a mortgage that’s right for you should be easy. But there are many programs to choose from and many ways to structure a loan.Before you begin, ask yourself these important questions:

-

-

-

How long do you anticipate living in your new home?

-

Do you expect any changes over the next few years, such as expanding your family or having children go off to college or move away?

-

Do you expect any changes in income due to promotions, relocations, retirement, inheritance or pensions?

-

Are you expecting a change in your investments?

-

Do you have a retirement plan at work and do you contribute to it?

-

Do you have other debt?

-

-

When shopping for a mortgage, you should always evaluate your choices carefully and consider how they will fit in with your long-term financial plan.

5 Financial Factors

Prepayment Penalty

Check to see if your current home loan has a prepayment penalty for paying off the loan early.

Essential Repairs

A leaky roof, faulty pipes, or finicky electrical work will impact the value of your home. Hire a home inspector to uncover potential problems. Consider completing these repairs up front or risk having them whittle down the asking price of your existing home.

First Impressions

Low-cost cosmetic changes can dramatically improve first impressions of your home. These might include a few new landscape touches, a fresh coat of paint, or updated fixtures.

Moving Expenses

Depending on how quickly your existing home sells and when you close on your next home, you may incur additional expenses. These might include temporary storage for your furniture and belongings. You may also have to rent an apartment or stay in a hotel for

a short time.

Timing

The housing market is continually changing. Your listing price may be impacted by the number of properties currently on the market, as well as the types of properties on the market.

Investment Property

Investment properties are investments in more ways than one. While you can realize significant income over time, you also will be making personal investments of time and money.

Consider the following tips:

Know the Going Rates

Research what types of properties are available and what the rental rates are.

Understand Full Cost of Ownership

When considering the income from rent, think about the expenses. The mortgage loan is only one of the expenses. Additional expenses may include taxes, insurance, license fees, utilities and upkeep (like paying a property manager or someone to mow the lawn and shovel sidewalks). Plus, you’ll have to factor in out-of-pocket expenses during vacancies. If nobody is there to pay the rent, you are responsible for the rent.

Know Your Personal Finances

Your total debt payments, including all mortgages, cannot exceed 36% of your gross income.

Learn About Tax Implications

Typically, interest on a second home mortgage is tax deductible. You will qualify for additional tax benefits on a rental as well. Talk to a trusted tax advisor.

Read Up On Your Rights and Responsibilities as a Landlord

Learn about local licensing and ordinances, rental agreements, the eviction process, and rights and responsibilities of landlords and tenants.

Identify Contractors

You’ll want to have a go-to list of reputable plumbers, electricians, and other service providers for general maintenance and emergencies.

Screen Tenants

Protect your investment. Create your process for screening tenants. Plan to run credit checks on all potential tenants. You’ll also want to call current and previous landlord references and find out about timely rent payments, as well as how tenants treated a property.

Buy vs. Rent

Timing couldn’t be better with low interest rates. You could own a home for as much as you pay rent.

-

-

-

Available first-time buyer down payment assistance

-

As little as zero-down loan options

-

Credit problems may be ok

-

-

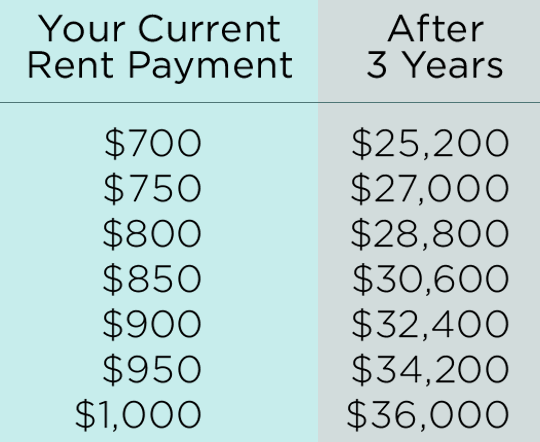

Over a 3 year period, the average renter can waste approximately $36,000 (after taxes) of their money when they rent instead of own.

12401 S 450 East F1 2nd Fl | Draper, UT 84020 | Office: 801.448.0066

Sunrise Lending Co. and its loan officers are not liable for information, claims, or agreements made by/between the public and third-party entities. These third-party entities may include but are not limited to real estate agents/REALTORS®, builders, or developers. Any information from independent vendors and data feeds may contain errors, outdated information or purchase conditions, promotions, incentives, and/or possible omissions. Sunrise Lending Co. makes efforts to update the information contained but cannot guarantee the accuracy of the information provided. We encourage buyers to complete their due diligence in deciding to build or purchase a home. We suggest that you seek the professional representation and/or advice of a licensed REALTOR®, as well as any other licensed professionals that are appropriate to your purchase decision, including but not limited to attorneys, accountants, or certified financial planners. Visitors to this site are responsible for the use and decisions made regarding the purchase of a home with regard to the information contained herein.

No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value (LTV) requirements, and final credit approval. Borrower approvals are subject to program guidelines, interest rates, and underwriting guidelines and are subject to change without notice based on the applicant’s current eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan, and a reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant.

Company NMLS 2526242

Company NMLS 2526242